Chapter 12 Taxable fuel provided for company cars and vans 480. List Price of Car Optional Extras Capital Contribution by Employee Maximum of 5000 allowed CO2 emmissions of car in gkm.

5 Environmental Benefits Of Electric Vehicles Infographic Environment Vehicle Electrical Electric Cars Electric Car Infographic Electricity

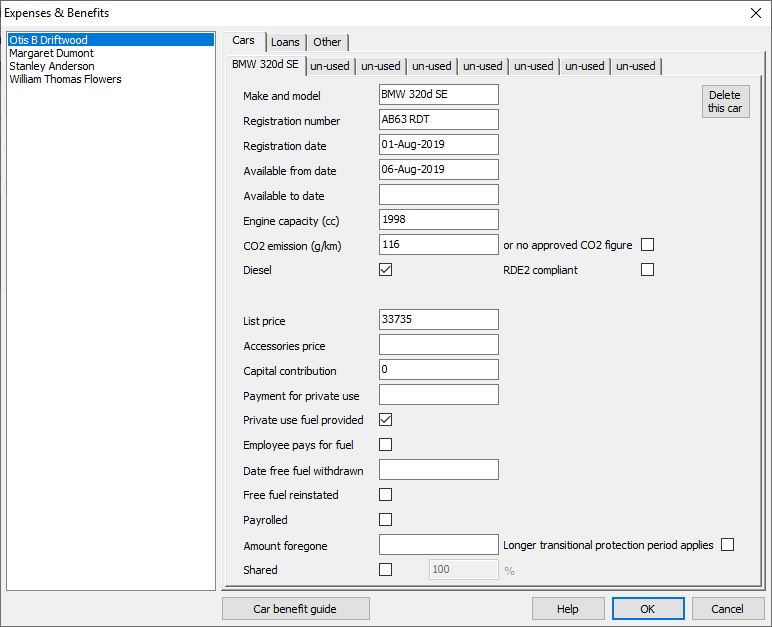

If no CO2 emission figure exisits for the car please enter CC of car.

. Company car and fuel benefit-in-kind. Why is fuel economy important. These calculations are for the 202122 tax year.

Car benefit calculator xls 91kb compute. Where fuel is provided for a car the benefit of which is taxed in accordance with Chapters 11 and 12 company cars a. To calculate the benefit in kind percentage you need to consider whether your car was first registered before 6 th April 2020 or after- as there are different tables for each see below.

These calculations are for the 202122 tax year. Advanced Cars Fuels. Capital Contribution by Employee.

For classic cars aged 15 years or more and having a market value of 15000 or more at the end of the year of assessment use the market value at the end of the year of assessment if this is higher than the adjusted list price. The taxable benefit on your company car is based on the CO 2 emissions of the car. My Plug-in Hybrid Calculator.

The benefit in kind or BIK tax is evaluated by multiplying the cars CO2 emission level the value of the car when new - including any modifications - and your income tax bracket. 30 rows The car fuel benefit is based on a set figure 24600 for 202122 202223 25300 x benefit in kind percentage for your company car. The fuel benefit charge for your usual car includes any fuel provided for the replacement car.

Use These Tips When You Need An Ohio Car Tax Calculator When Determining How Affordable A Vehicle Is. For the full table see the page on car benefit charge. Car and Fuel Benefits Calculator.

About Hybrid and. How to work out the benefit of a company car 480. Choose fuel type F for diesel cars that meet the Euro 6d standard.

Zero emission Miles if CO2 emissions are between 1 - 50 Not applicable 130 70-129 40-69 30-39 Less than 30. Provides an indication of the Income Tax you would be liable to pay for the provision of company car and car fuel benefit. Instantly Compare With Taking A Cash Allowance Instead.

VAT Flat Rate Scheme Calculator. Maximum of 5000 allowed CO2 emmissions of car in gkm. We can help you calculate and track your fuel economy.

The CO2 emission figure can be found on your car. MPG Estimates from Others. Now that the car has gone could anyone please help me understand the calculation of the fuel card.

The figure for 201920 is 24100 but this has increased at an inconsistent rate since being introduced in the 200304 tax year the table below shows. Updated for tax year 2022-2023. The list price of the car and the cost of any optional extras.

Car and Fuel Benefits Calculator. The taxable benefit on your company car is based on the CO 2 emissions of the car. Working Sheets Working Sheets follow to help you calculate the car and car fuel benefits for each car made available to you in the year.

2000 x 5 100. Just select your vw polo from the list to calculate. P11D WS2b worksheet to calculate the cash equivalent of car and fuel benefit you provide via optional remuneration arrangements to an employee or director You do not have to use these forms but.

Child Tax Credit and Working Tax Credit. Total value of taxable car benefit from 1 january 2019 to 31 december 2019 1420 6196 7616. Company Car Tax Calculator Company Car Tax Calculator On Older Cars.

Lotus unveil the Eletre an all-electric hyper-SUV 01 April 2022. That is the CO 2 emissions derived percentage used to calculate the car benefit charge. Does my now privately owned car play a part in calculating the benefit of the fuel card or is it excluded from the calculation.

List Price of Car. Or you can use hmrcs company car and car fuel benefit calculator if it works in your browser. The list price of the car and the cost of any optional extras.

The calculator allows calculations for. The fuel benefit charge is reduced to nil if the employee is required to make good the full cost of all private fuel and does. Allows you to calculate the benefit in kind value of a company car and if appropriate the car fuel benefit.

Company car and fuel benefit-in-kind. To calculate how much fuel benefit youll have to pay you need to calculate the vehicles benefit in kind with a fuel charge multiplier. Help Promote Fuel Economy.

Fuel benefit charge is one of the figures used to calculate company car fuel benefit. Calculate The Company Car Tax And Any Fuel Benefit Charge On Your Actual Income. The fuel benefit charge is calculated by multiplying the fuel benefit charge multiplier by the cars appropriate percentage.

Calculate the company car tax and any fuel benefit charge on your actual income. An Introduction to Self-Assessment. Or you can use HMRCs company car and car fuel benefit calculator if it works in your browser.

You can work out the value manually on. Fuel Benefit Total Car Fuel Benefits For classic cars aged 15 years or more and having a market value of 15000 or more at the end of the year of assessment use the market value at the end of the year of assessment if this is higher than the adjusted list price. MPG estimates from drivers like you.

Its a cash sum thats set by HMRC and that can and often does change every financialtax year. My total mileage is around 25000 a year and is mostly private mileage. The approved CO2 emissions of the vehicle - you can look it up on the official government website.

Car Fuel Benefit Calculator. You can also optionally add your capital contribution. Remember you can enter a cash allowance to compare if getting a vehicle privately would be worth it.

You can work out the value of cars and fuel using online tools from HM Revenue and Customs HMRC or your payroll software. Just select your vehicle or enter the P11D value and BIK rate to calculate. Instantly compare with taking a cash allowance instead.

Chapter 13 Benefit charge on company vans available for private use 480. CO 2 emissions gmkm. Smart unveil all-electric crossover the Smart 1 08 April 2022.

If the car is unavailable for part of the year the benefits are proportionately. After that there are completed Working Sheets using the details in the example below. Using the HMRC calculator.

Car and Fuel Benefits Calculator.

Company Car Fuel Benefit Guide Icompario

0 Comments